Trading with the DOM (Depth of Market)

In this video, one of our founders gives a breakdown on concepts with the DOM (depth of market) and some actionable ways to incorporate it into you...

Using the Time and Sales

In this video, one of our founders gives a quick breakdown on trading with the Time and Sales and how to utilize it in your trading.

Trading with the Volume Profile

In this video, one of our founders gives a quick breakdown on the volume profile, what it is and some setups/ideas on utilization in trading.

Market Profile | Single Prints and Trading WITH Trend.

Market profile, or TPO charts, essentially organize a 30-minute candle chart by using letter sequences to represent each 30-minute period. For exam...

Point & Click : Discretionary Difficulties of Entry and Watching a Move Run

When Planning Meets Panic You've done your homework, charted out the battlefield, and you know where you want to strike. But as soon as you're abou...

Minding Your Ps and Qs

Minding your P's & Cues (Positions/Planning and Market Cues) In this post, we'll delve into the facets of trading from an unconventional pers...

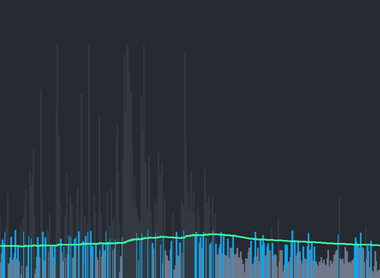

Guiding Intraday Strategy with Relative Volume

Relative Volume (RVOL) is a simple mathematical formula that compares the current volume to a prior lookback period, such as the previous 5 days or...

Volume Builds

Building a View of the Activity As intraday traders it’s easy to be blinded by viewpoints that are based upon timeframes that are irrelevant to t...

Up or Down?

UP or DOWN? One aspect of trading I continue to reference is “Structure Precedes Execution”. Meaning it’s important to map out areas of interest ...

Dialing in your Trading Performance

Most traders use monetary results to determine how they’re doing day-to-day. On the one hand this makes sense given that for many of you money is t...

Math. Can it make us better traders?

When an apple stem breaks from the tree branch, the apple falls to the ground (Newton’s law of universal gravitation). This happens every single ti...