What is Order Flow?

In this post, we are going to dive into the overall view of what is order flow? I will discuss some of the tools, some of the concepts and ideas behind it, and help define the general concept of what order flow is and how it can possibly be utilized in your trading.

Alright, let's dive in. So, order flow, what is it? Order flow trading involves visualizing the interactions between the buyers and sellers, in order to identify control of the current auction. The rawest form of order flow activity is visualized with the time and sales- also known as the tape. As buy and sell volume enter the market, that relationship of how they interact, can give an individual an edge or a map of who is controlling the auction, and who is most interested in aggressively entering position.

Why would we use it? Well, it is non-lagging, it is not a moving average, itis not anything that is delayed. It comes straight across your screen in an immediate stance, from a centralized order book, the futures. Centralized order book means that there’s no hidden orders out there. All of the orders are displayed right in front of your face on the Depth of Market. And that relationship helps you really gauge an understanding of what is occurring in the current environment.

So, what are some order flow tools? Well, this is a non-exhaustive list, but some common tools utilized are: Time & Sales, Depth Of Market or the DOM, Volume Profile, Delta (It can be delta by price, could be cumulative delta, different forms of delta), and also Footprint Candles. These are out-of-the-box tools which are available in almost every major charting platform. So, let's dive into each category of tool further.. The DOM and the time and sales are certainly the basis of order flow trading. On the DOM, the depth of market, what you’re actually seeing is a list of resting orders. That data in the book is used to determine which transactions can be processed, and engage the transactions that are occurring as they occur. What we can see here is the resting sell side here in red, and the resting buy side on the right. Over here on the left, we can actually further break up those order quantities and see: are there some orders that are larger and waiting? Or are they conglomerates of smaller sizing? Asthat activity transacts back and forth, it helps us gauge an understanding of low risk areas to interact with the market.

The Time & Sales shows volume, price direction, and the timestamp of the actual trade data that has transacted. And so you can see here, you see a time/price that the transaction occurred and the volume itself. The coloring also tells you a bit of a story: were they aggressive? Did they jump up and buy it at the market? Did they dive down and sell it at market? Or are they waiting there and just filling their positioning?

Now this comes through quickly but all of this activity is essentially starting here in the resting order book. A. A way that we look at this and start to form a story is by putting the Time & Sales and resting order book, or DOM, side by side. On the left here, you can see the DOM sitting directly next to the tape. Although it seems a little overwhelming if you’re not used to looking at this information, it tells a very clear story of who is actually sitting on the book, what is occurring at a particular level of interest, and where the auction could be going or if we are reaching a potential point of exhaustion.

Next, we are going to talk about the volume profile. Volume acts as interest in the market. You can clearly see areas where there is more volume, and areas where there is less volume. Now the volume is displayed vertically against price rather than at the bottom. This tells us that certain price levels where there is more or less interest. is the level of interest is particularly useful in both intraday trading and on larger timeframes. Using the volume profile, we can see where interest dwindles, and where there was high interest that may attract price back to that area. Also, it tells us where there was no interest in facilitating trade which can also speak to us.

As you can see, volume by price or the volume profile is another tool to gauge the inventory or the actual order execution that is occurring live and in the current market scenario. Here, in the middle, what we can see is instead of looking at the total volume, this is delta. Delta is the ask minus the bid. So it’ll show us an overwhelming one-sided transaction. So, for instance, this negative 230 here, tells us that however many orders are transacted here, we have 230 more sell side, then we do bid side. And so this here helps us get further information out of something like a volume profile, and utilize it on an intraday basis.

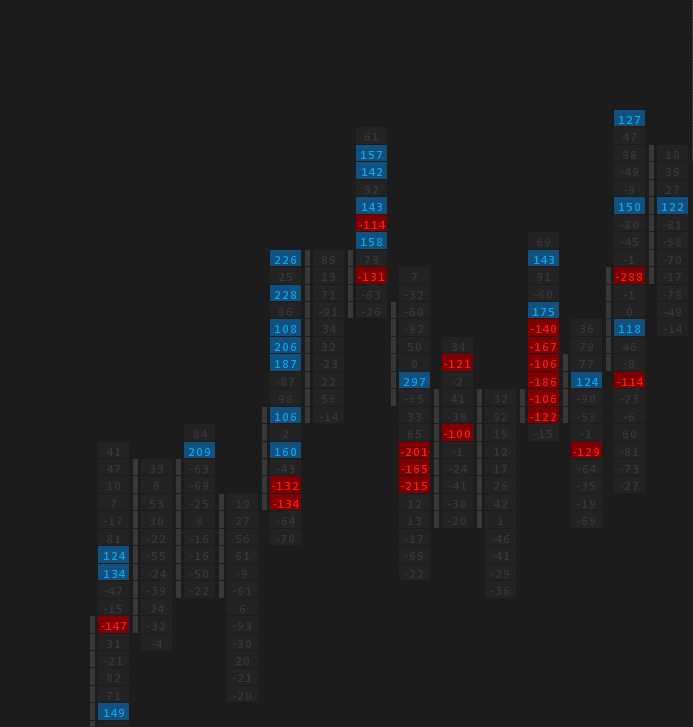

Moving on, our next tool will be the footprint candle, also known as number bars. A footprint candle can be placed on any particular time frame that you wish. It maps the buy versus sell on the candle itself and shows you a picture inside the occurring auction.. Rather than just looking at a candlestick, you can actually gauge the volume that is inside of the candle, along with the Delta and see where repeating auction activity occurs. This is particularly useful to gauge structural areas or zones where there might be absorption or initiative trapped interactions within the market activity.

Again, like I said, this is not an exhaustive list. These are some of the most common tools that are utilized to gauge order flow activity. Very simple, very direct. Utilizing them requires the understanding of multiple nuances- and understand that comes with time and visualization. We will be doing a series of videos on each of these products to help you gauge market activity better. These are all the things that can be found out of the book –or out of the box with certain platforms..In my opinion, these tools are absolutely essential to order flow trading.

Lets now cover the benefits and misconceptions around order flow. Well, as far as benefits goes, it is live data. It is occurring right now. It’s very clear and concise. You can see who is actually participating in the auction and who is not. If somebody is finding more interest in a zone and which direction they are leaning towards pushing that auction activity.

My favorite part about order flow is it helps me with tighter risk management. If I know the positioning of other players that are in the market, then I can not only gauge my risk against them in a very close manner, but I know when I’m wrong. Knowing when you're wrong is the majority of the battle with a lot of futures traders in general. We’ve all heard of people holding on to trades that were not going in their favor, and subsequently causing much harm to their trading account, and not only that, but emotional harm. The inability to gain confidence along the way because of lack of understanding where to actually engage, creates a cloud over anybody’s head. Tighter risk management certainly is a key factor. These tools give a clear and concise understanding of risk.

Now what is order flow not? It is not a holy grail. It is also not easy to learn or risk-free. So, knowing that you have the ability to gauge this type of information doesn’t mean that you can plan on just hitting home runs every single time you press a button. It does take time to learn, it takes time to understand the interactions of the auction. If it were easy, then more people would be doing it. There are no holy grails in the market. There are always exceptions. And so what order flow trading does for me is it helps me stack the chips in my favor and place higher probability trades with tighter risk management and wider reward against my risk.

In summary, order flow trading involves visualizing those interactions between the buyers and sellers. We’re talking about price, volume and time; those three variables can be seen with the resting orders on the book, the executed orders, the Time & Sales, the overall inventory through your volume profile. In the volume profile, if we have a high-volume area, is it heavily weighted to the bid to buy or sell side? Your footprint chart, seeing who’s actually at play within the candle.

These factors create a great cognitive map and understanding of the live intraday auction, an absolutely essential understanding with any futures trader. Order flow lets us utilize the relationships of all this information to create the tools that we utilize. But like I said, we’re going to be creating further through a series of understanding just the basic concepts of each of these tools and their actual true benefits of utilization right out of the box, and I look forward to diving into some deeper concepts with you all.