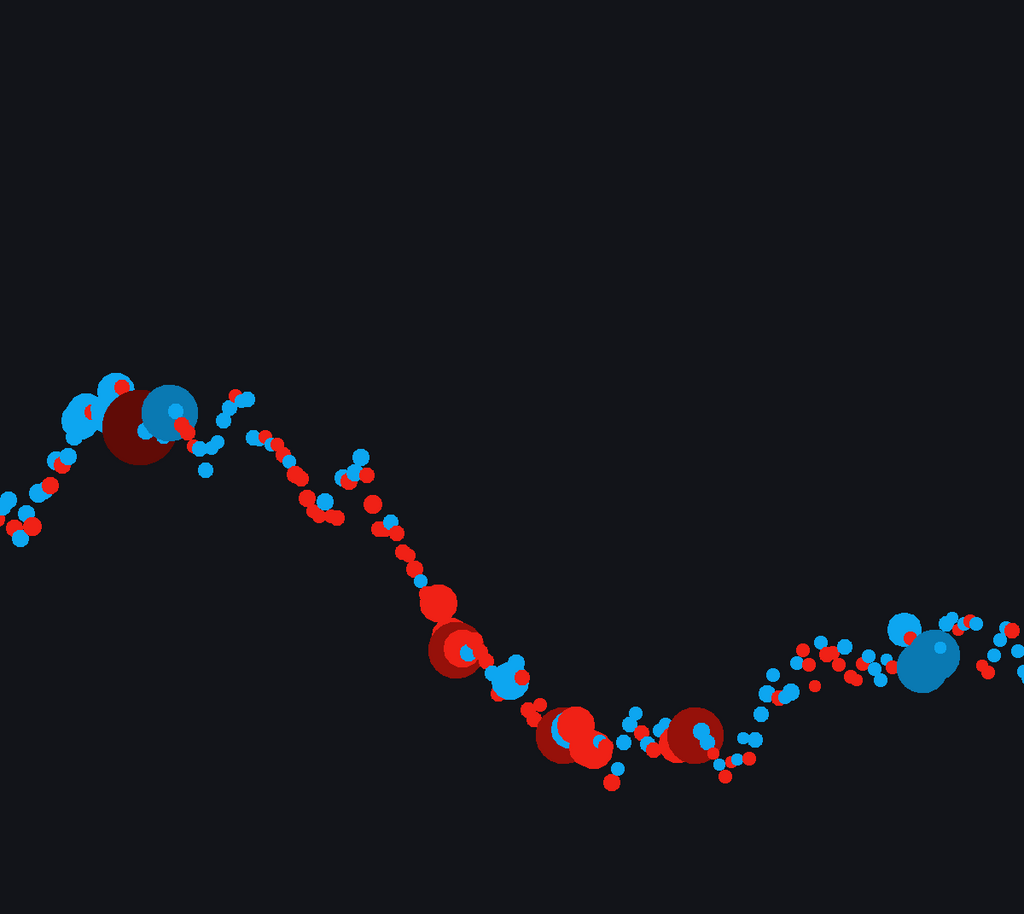

Time and Sales is an OrderFlow tool we use to identify market players and try to gauge what is likely happening in the market we trade by nuances in the Tape aka Time and Sales will refer to as Tape from here.

Simply stated, the Tape is a “receipt” of all the market orders going through. We can see the time of transaction, the size or volume of lots traded as well as the type of trade or how it was transacted and other information as well.

There are 4 Order Types you will see on the Time and Sales

- Bid

- Below Bid

- Ask

- Above Ask

An ask trade is telling you that a buyer bought x qty lots on the ask, a bid trade is telling you that a seller sold x qty lots on the bid. Above ask is telling you that a buyer is sweeping the current ask and the next price up. You’ll see the transaction come through as ask and then above ask. Below bid is the opposite of the above ask, a seller is selling enough contracts to sell the bid and the next price below it, also called a sweep.

The above ask and below bid trades are usually just referred to as “sweeps”, the participants are trading large enough size that they take both the current bid or ask and the next level above or below. These sweeps are considered aggressive. We want to take note of this aggressive behavior.

Now that you know what the tape uses are, let's discuss three concepts that are important.

- Aggression

- Speed

- Absorption

Aggression - It is aggressive behavior that I watch for on the tape to see how participants are responding to each other. If someone is slamming the bid and below bid I want to make a mental note of that. Conversely if someone is slamming the ask and above ask, I want to keep track of that as well. Often in areas of interest you will see one side in control and then all the sudden an aggressive response from the other side. These can be potential turns in the market and perhaps a good place for entry. How do you spot this aggression?

Aggression can be seen as non-stop trading from one side firing off many small size lots, or firing off many small size lots and then sweeping the book with larger lot sizes which gives you the above and below trades we noted earlier. We need to be aware of this aggression.

Absorption - Can be stated simply like this.. If you see aggressive buying/selling like we just covered and price is not moving, that indicates absorption. If aggressive buying is seen on tape and price doesn’t move then it’s likely someone on the other side is absorbing that buying pressure and holding price, aka they are reloading the offer into the buying. Usually the buying stops and price will start to drop because the seller in this case is still selling. However, if the seller in this example does not continue and the buyer does, we can potentially see a large move to the upside because now that seller is offside. They sold all they could and the buyer is now squeezing them out of their position. So now we have the original buyer initiating their buying and the seller is now being forced to cover (buy) their existing short position.

Speed - Is one of the most important tools I use when executing reversal trades or rebid trades. How quickly orders are coming through is also a measure of aggression and it indicates someone wants to get business done right now. Speed is often the most important concept to use in tape reading. Let’s say you start to see sweeps come in above ask, they follow through, price starts moving in their direction and then that activity picks up very quickly. That is telling you that someone is rushing into the market and they’re in a hurry. This is tradable information! You have aggressive buying and a rush of it.

Now that you have some of the basic information on tape reading, go get your time and sales window and start looking for these patterns!