Overview

Price action is the general feel and flow of how the market is moving moment to moment on the intraday time frame. Price action is a function of the speed at which orders come into the market and the liquidity being provided to fill those orders.

Evaluating Price Action

As intraday traders it is our job to extract what we can from the market each day regardless of what kind of price action we get. The market is going to behave in whatever manner it wants, and we need to make the necessary adjustments. We must shed our bias and remain objective while seeking opportunities conducive to the current price action.

It is a good practice to take a moment and check in throughout the session about what kind of action we are getting. This allows us to manage expectations for our positions. Generally, there are three types of price action we are likely to see:

- Tight and grindy action, slowly ticking up and down, not many rotations

- Should be extremely selective and generally take less trades on these days

- We scale into our trades much slower than normal

- The market not likely to give much, so take what we can get

- Normal rotational action, good moves in both directions

- We want to be active these days, this is when our edge works the best

- We scale into trades at our normal pace

- Take base hits on core and be tactical milking winners with clear targets

- Extremely volatile action, whippy and violent moves in both directions

- These days present both extraordinary opportunity and risk

- We want to be active while being very patient and disciplined

- Profits can come and go quickly, so feel free to walk away early if having a good day

Environment Overview

The environment is the summation of high time frame structure, intraday structure, price action and other important variables. Putting all these conditions together gives us a broad sense of what is going on in the market. We should always have an awareness of the current environment. However, we want to stop short of it giving us a significant bias.

Environment Deep Dive

The environment is a combination of many different variables. There are no hard rules or definitions to put into application, it varies from trader to trader. Everything that is going on in the market that is important to each trader is what makes up the environment.

Personally, I observe the environment through the lens of my chart book. The activity occurring on my high time frame charts, intraday charts and order flow charts all put together make up my environment. Here are some examples of some of the thoughts I am working through:

- Are there any areas on our high time frame or intraday charts that are likely to serve as major support/resistance or lead to balance or momentum?

- Are there any clues in the order flow data to indicate strength on one side or lack of interest?

- Where is the intraday structure that I can lean on for trade location?

I think an apt analogy for observing the environment is like the Offensive Coordinator at an NFL game. The OC sits in a suite above the field viewing everything happening from a higher point of view. They do this to get the full picture of what is happening in the game and that perspective guides them on what plays to call. Throughout the session we are taking in everything happening on our charts, the environment, and putting it together to guide our decision making.

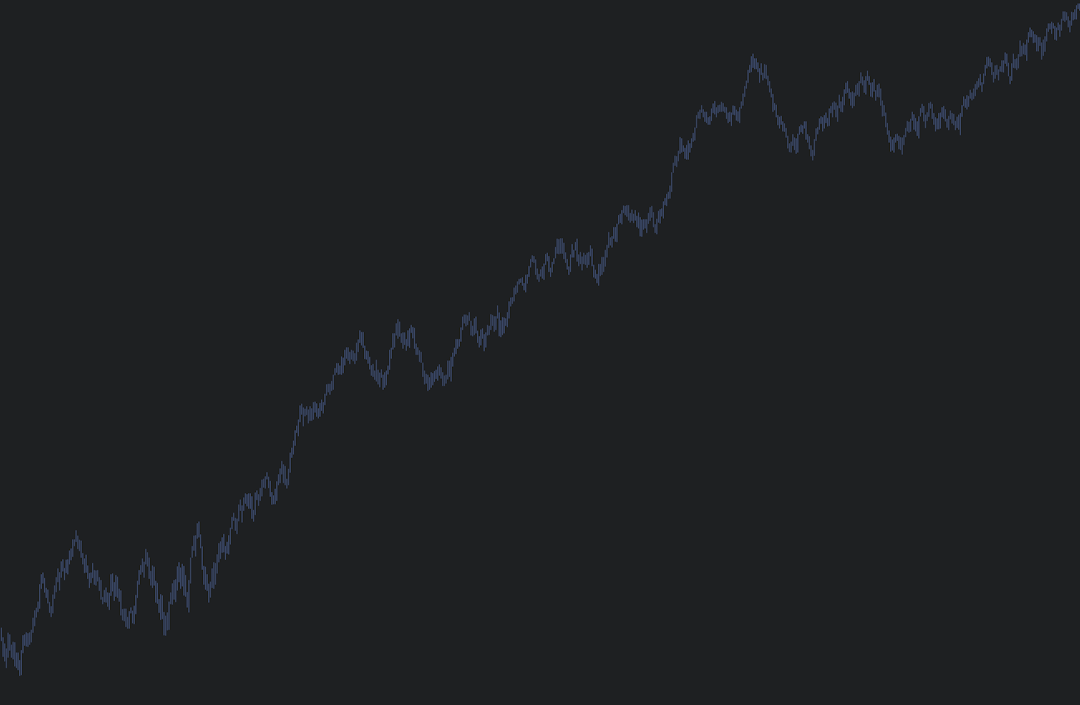

Example (slow grind day , offers shallow pullbacks)

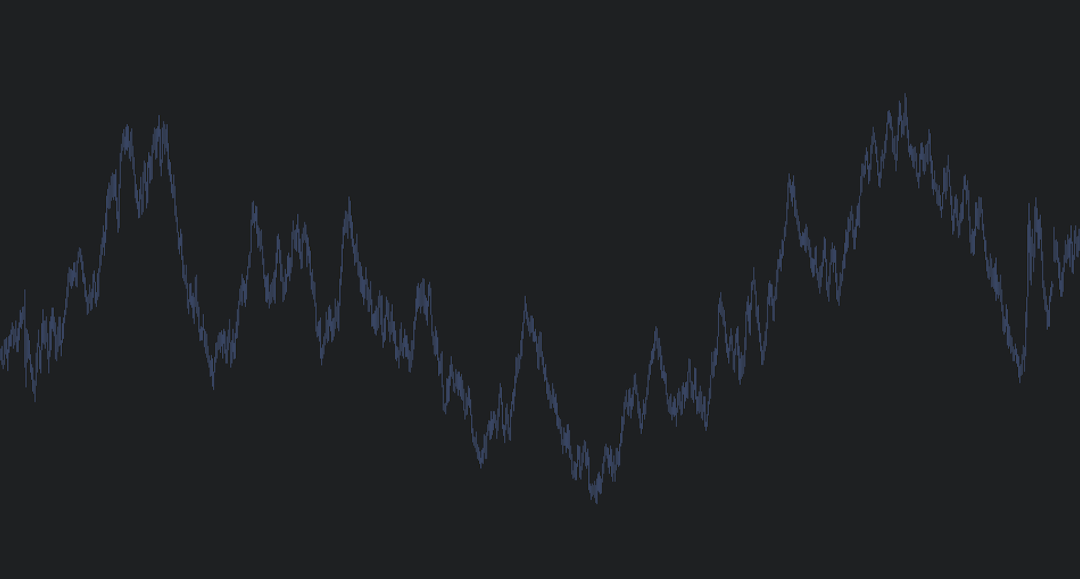

Example (normal rotational day, we are most active on these days)

.png%3Ftable%3Dblock%26id%3Db0c94e6c-32b8-4b21-a070-3e95890d2d18%26cache%3Dv2&w=1080&q=75)