Overview

Exhaustion is a burst of high-volume or high delta activity that may be a signal the current rotation is coming to an end or is at least pausing temporarily. This may be observed as a relatively quick and aggressive move in price at the extreme edge of a rotation that does not get any follow through. Exhaustive moves happen across all time frames.

Identifying Exhaustion

Exhaustive activity is something that can be clearly identified in real time and is an actionable event. When we have a trade idea, we are looking to start putting risk on at optimal trade location, which means buying rotation lows and selling rotation highs. Observing exhaustive activity gives us a clue that we may be developing a swing extreme.

Some of the characteristics of exhaustion are:

- Delta Bubble from OFL Delta Map Study

- Burst of very high volume

- Significant positive delta on a pop up, negative delta on a pop down

- Decreasing volume right after the pop

- General lack of follow through after the burst of activity

- Happen at rotation highs and lows

It is important to note that exhaustion and initiation have some similar characteristics. The most important distinction is what happens after the burst of activity. If the activity finds follow through then it is likely initiation, if it does not then it is likely exhaustion.

Intraday Rotation Exhaustion

We will look for signs of exhaustive activity at the extremes of intraday rotations throughout the session. Observing this activity can be a clue to start putting risk on if it occurs in an area of interest, or it can be sign for us to take profit on a trade if we already have risk on.

We want to be cautious of what we perceive to be exhaustion of trend type activity. We only want to put on a starter position when fading momentum (knife catching), and it is generally best to take a more guarded approach managing a counter trend trade.

Exhaustive Pop

We have identified a market nuance that we will call an exhaustive pop. This is when price has paused at an intraday rotation high or low, and we are observing a bit of absorption. We then see a very quick “pop” or “spike” of high volume and delta in the direction that price has been attempting to go that is met by immediate response from the side that has been absorbing. This is one of the key things we want to see when scaling up in a trade. We want to lean heavily into this activity and we may opt to pile into risk when the conditions are right.

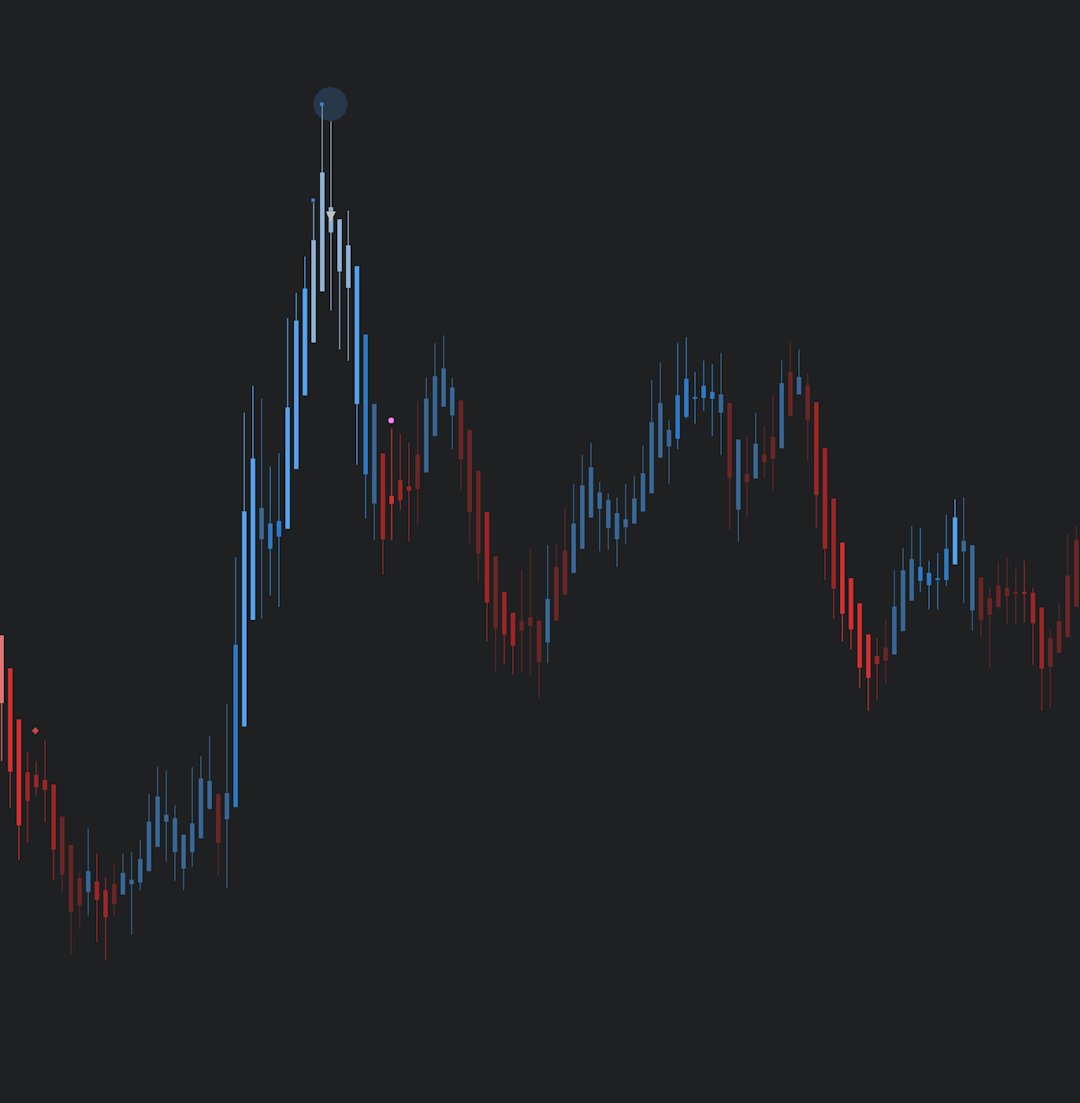

Exhaustion Example (DeltaMap)

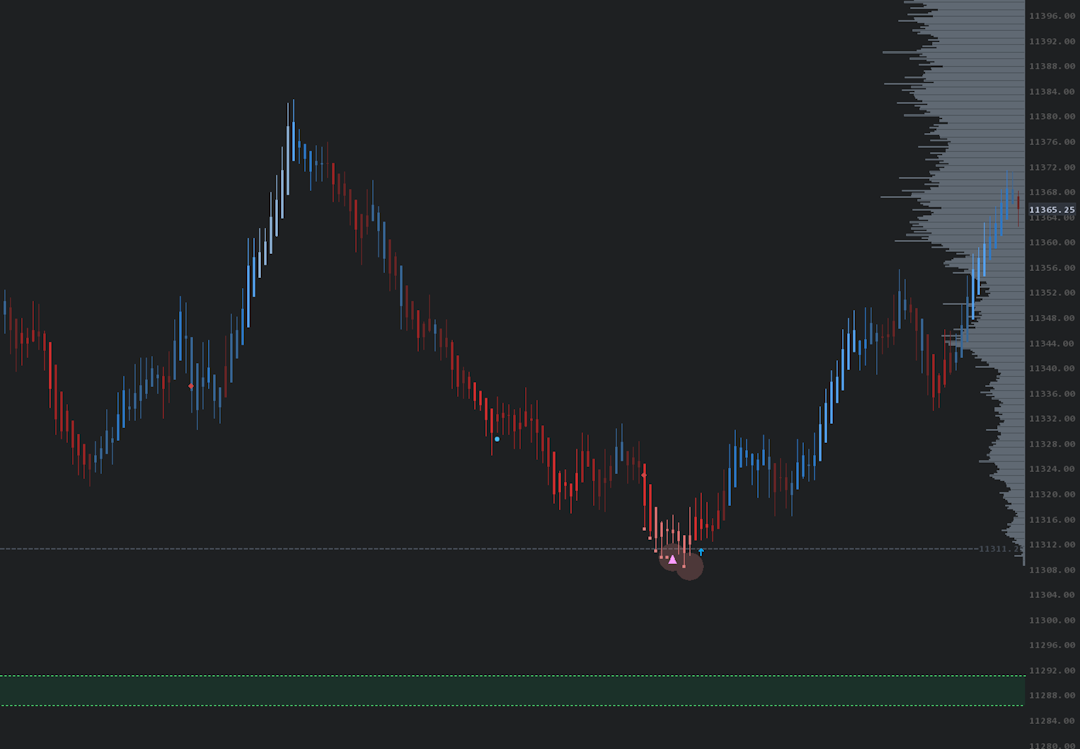

Exhaustion Example (Delta Map + EAD + Dominator)

Especially near good reference points, the green zone just below is an RTH gap. Sellers exhausting into a key support area.

.png%3Ftable%3Dblock%26id%3Db0c94e6c-32b8-4b21-a070-3e95890d2d18%26cache%3Dv2&w=1080&q=75)